-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Solomon Titus Gushibet* and Gadong Toma Dalyop

Corresponding Author: Solomon Titus Gushibet, National Institute for Policy and Strategic Studies (NIPSS), Kuru, Jos, Plateau State, Nigeria.

Received: February 10, 2025 ; Revised: April 24, 2025 ; Accepted: April 27, 2025 ; Available Online: May 06, 2025

Citation:

Copyrights:

Views & Citations

Likes & Shares

The study examines the ways in which the Central Bank of Nigeria applies monetary policy to control money supply in the economy. Through the money multiplier approach and the monetary base, the study illustrates how the demand for and supply of high-powered money could affect economic activities in the country. It implies that the control of money supply and monetary variables by the monetary authorities is, from a policy point of view, crucial. The methodology of the study is by modelling approach to derivation of money multiplier and the determination of money supply process in Nigeria. This involves modelling of money multiplier as it causes changes in money supply. The vector error correction model was used as the analytical technique. The approaches suggest the importance of facilitating better insights into the money multiplier movements particularly in the post-reforms period and the movements in broad money. It also reveals that uncontrolled money supply could lead to economic instability. The study recommends that alternative approaches to control of monetary variables should be targeted at moderating money supply levels in the economy. The increasing stochastic economic environment in Nigeria requires the application of probabilistic techniques such as the Monte Carlo simulations and value at risk (VAR) models as useful policy guides or choices for monetary authorities and policymakers.

Keywords: Money multiplier, Money supply, Interest rate, Monetary base, Economy

JEL Classifications: B23, E52

INTRODUCTION

The Central Bank of Nigeria (CBN)controls the supply of money in the economy through monetary policy. Monetary policy refers to the regulation of the value, supply and cost of money in the economy through specific actions taken by the Central Bank with a view to achieving macroeconomic stability. The control of money supply is meant to achieve price stability and accelerate economic growth and development. For the CBN being the banker to the government, banker’s bank and the sole issuer of legal tender, it is expected that controlling the supply of money in theory would be an easy task. However, this has not been the case in practice. There are three important instruments through which the central bank might seek to affect the money supply. These include reserve requirements, the discount rate, and open market operations. The analysis of the determinants of the stock of money supply is usually carried out over three types of frameworks. These are the money multiplier approach, the adjusted monetary base and the constituents’ approach [1]. The money multiplier is the ratio of deposits to reserves in the banking system, and reserves are the amount of deposits that the central bank requires banks to hold without lending. The adjusted monetary base is the sum of currency (including coins) in circulation outside the central bank plus deposits of depository institutions in the central bank. The constituent’s approach to money supply consists of currency money (coins and notes) and bank money (chequable demand deposits) with commercial banks. The limitation of the constituent’s approach is that it ignores the influence of institutional money like portfolio investments, foreign assets and deposit of depositary institutions. Thus, a combination of money multiplier and the adjusted monetary base approaches suits the Nigerian context.

The seeming ineffectiveness of monetary policy to control money supply that will impact on economic aggregates for macroeconomic stability in Nigeria motivates this study. The current instability in macroeconomic indicators such as inflation rate, exchange rate, unemployment rate, slow and negative growth rate and the recent economic recession have justified the study. The fact that effective formulation of monetary policy depends on an understanding of the determinants of money supply makes the need for empirical investigation into this area crucial. Since the movement of money/currency can stimulate economic activities, generate employment and income, and strengthen domestic output growth, its mismanagement can create inflationary pressures, economic recession, eventual depression and poverty. It implies that effective control of money supply is necessary to arrest monetary disturbances in the macroeconomy.

From the foregoing, the objective of the study is to examine the way in which the Central Bank of Nigeria applies monetary policy to control money supply in the economy through the approach of the money multiplier and the monetary base for the achievement of macroeconomic stability. The paper x-rays a more dynamic money multiplier derivation accompanied by empirical investigation with a robust analysis with evidence from Nigeria data rather than the conventional static approach as a contribution to knowledge. The empirical analysis further seeks to determine the relationship between the money multiplier and money supply (between 1983 and 2017) through analysis of different definitions of the money multiplier to ascertain the most applicable to the Nigerian context. The money multiplier is theoretically dependent on policy actions of the central bank in any given economy. Knowledge of the multiplier has, therefore, become necessary for government and policymakers to manipulate the high-powered money base to achieve the desired stock of money supply that could be in tune with macroeconomic stability. The study is divided into six sections. The foregoing is the introductory section one. Section two reviews related literature and concepts. While section three explains the modelling approaches, section four describes the methods, types and sources of data, pre-test and the analytical tool. Section five analyses the data, presents the results and discusses the findings. Section six concludes the paper with policy recommendations.

REVIEWS OF LITERATURE AND CONCEPTS

Conceptualizing Money Supply and the Money Multiplier

Several studies have investigated the concepts of money supply and the money multiplier. Anyanwu and Oikhenan [2] contended that money supply is the total amount of money in circulation as well as demand deposits in a country at any given time. Demand deposits are those financial obligations that are not connected to payments of interest but are accepted as a means of exchange that are drawn without notice by way of cheques. The money supply is currency in circulation outside the banking system plus the deposits of commercial banks and building societies. Money supply is related to the monetary base; the amount of high-powered money issued by the central bank in the form of notes and coins in private circulation plus the quantity held by the banking system or commercial banks [3]. According to Begg, Dornbusch and Fischer [3], the money multiplier is the extent to which the money supply is a multiple of the monetary base. It implies that the larger the money multiplier, the smaller the cash reserve ratio of commercial banks and the smaller the private sector’s desired cash-to-bank deposits ratio.

Money multiplier is thus the change in the money stock for a N1 change in the quantity of the monetary base. This depends on two key ratios: the bank’s desired cash reserves-to-total deposits ratio, and the private sector’s desired cash in circulation-to-total bank deposits ratio. It is this movement of currency that stimulates economic activities, induces investments, creates employment, generates income and influences output growth in the economy. It could also create inflationary pressures, economic depression and poverty. This implies that the control of money supply is essential. For effective monetary policy, money supply should be kept under effective control by the monetary authorities.

The Money Multiplier is a mathematical relationship between the monetary base and money supply of an economy. It explains the increase in the quantity of cash in circulation created by banks' ability to lend money out of their depositors' funds. A bank 'creates' money when it makes a loan because the loan becomes a new deposit from which the borrower can withdraw cash to spend. The fractional reserve system under which banks are required to keep at hand only a portion, which is typically between 10 to 15 percent of depositors' funds, is the basis for this money-creating power. The rest may be converted into loans, thereby increasing the available cash by a factor that is a multiple of the initial deposit. This study sees money multiplier as the expansion of a country's money supply that results from banks being able to lend for investment, employment generation and, income and output growth. The proportion of deposits that banks are required to hold as reserves determines the size of the multiplier effect. Hence, it is money used to create more money and is defined as the ratio of total bank deposits-to-the reserve requirement.

Theoretical Underpinning

The study tracks the theoretical framework on money supply process through the money multiplier approach in Elueni [1], Ajayi [4], Davis and Gauger [5] and Gauger [6]. The money multiplier approach holds the view that money supply is the result of the interaction between the money multiplier, the demand for and the supply of high-powered money. A further development of the multiplier approach is based on the notion that the shortcomings in the money multiplier approach can be corrected by adjusting the monetary base within the same model. This is based on the belief that isolating certain policy variables can increase the explanatory power, and the predictability of the money multiplier approach [4].

In the multiplier approach, the determinants of money supply are high-powered base money and the money multiplier. The former is made up of three constituents: net foreign assets of the central bank, the central bank’s net claim on government and the banking public. The first two of these, net foreign assets of the central bank, as well as claims on government, are outside the direct control of the CBN. Foreign assets are dependent on the balance of payment account of the country. It expands or shrinks if the balance of payment account is surplus or deficit, respectively. Depending on the exchange rate system of the country, interest rate movement and arbitrage can cause large scale international capital flows, which may be significant enough to frustrate the domestic monetary action. A very low interest rate may cause a movement of capital in search of higher returns into other countries and cause the external reserves or money supply to fall, and vice versa [5].

Net claim on government is determined by the borrowing requirements of the federal government. Government can finance its deficit expenditure requirements either by non-money borrowing domestically or externally, or by money creation. Although the monetary implications of these borrowings can be taken into consideration, many other factors also enter into the budget decisions process. To the extent that these factors are political in nature, they are outside the control of the monetary authorities. It implies that the only constituent of the high-powered base money over which monetary authorities have control is the net claim on the banking system [6].

It has been shown above that the determinant of money supply is the multiplier. The multiplier is determined by the demand for currency by the public, their portfolio choice between demand, time and savings deposits as well as the cash reserve requirement prescribed by the central bank. The above indicates that the control of money supply often involves difficult struggle with the stock of money or the high-powered base money [1,7]. They identified four determining factors in the struggle to control the supply of money by monetary authorities. First is the size of the public sector deficit. If the public sector deficit is large relative to the gross national expenditure, the struggle will be greater. Second is the elasticity of substitution between foreign and domestic assets of the central bank. Third is the market reaction to monetary authority’s policies in the form of open market operation, reserve requirements, etc. Fourth, the elasticity of demand for advances which ultimately allows the bank to create money.

Literature Review

The literature on money multipliers has focused on forecasting money multipliers at the aggregate and disaggregate levels by implicitly assuming that they are unaffected by macroeconomic variables. With the help of ARIMA modelling techniques, Johannes and Rasche [8] tried to forecast the multiplier at the aggregate level, while at the disaggregated level, Johannes and Rasche [9,10] extended the time series approach to forecast the money multiplier using a ‘component’ approach and attempted to model and forecast the individual ratios that comprise the multiplier. Since certain events that influence the individual ratios could be hidden in the aggregate model, the disaggregated approach provided significant advantages. Thus, the advantage in modelling the component ratios would be obvious in superior predictive performance of the model.

However, there has not been conclusive evidence on the superiority of the components approach over the aggregate approach. The aggregate model was found to produce reasonably accurate out-of-sample forecasts when compared with a components approach [11]. A drawback of both approaches is that they ignore the impact of macroeconomic variables including real income and interest rates. Multiplier movements were identified by Gauger and Black [12] as a foremost source of volatility of aggregates, although, they did not analyze factors causing such multiplier movements. The simplifying assumption that ignores economic variables in forecasting multipliers has been questioned as the financial environment has become more complex in recent times. Advances have been made in payments mechanism and financial innovations that have the potential of making asset holdings more responsive to interest rate movements. Consequently, there would be implications for understanding the money supply process and monetary-macroeconomic interactions in a liberalized financial environment as well as identifying a source of endogeneity of the money supply if multipliers are endogenous [13].

Some macroeconomic models that have incorporated financial innovations have attributed changes in nominal money supply to changes in the money multiplier and, thus, contended that movements in the money multiplier aid in explaining the observed relationship between the money stock and real output, and, consequently, innovations in money multipliers help predict innovations in real output. These models seem to provide better understanding of the monetary impacts on the economy [14,15]. Manchester [16] found that innovations in the money multiplier may enhance understanding of the impact of monetary disturbances. Gauger [6] found that M1, M2 and M3 multipliers in the US were affected by certain opportunity costs, the yield curve and real income. Additionally, changes in the substitution patterns among monetary assets were bought about by changes in the interest rate. Davis and Gauger [5] have robustly proved the substitution between monetary assets in alternative money supply measures. Similarly, Jha and Longjam [17] identified inter-monetary assets substitutability in the representative consumer’s utility function in India. Although not all multipliers may be affected by all opportunity costs and substitution patterns between monetary assets would determine the impact of interest rate spread on a multiplier, they concluded that a larger interest rate spread had a positive impact the component of the multiplier containing the higher return asset and a negative on the component containing lower return asset.

Several studies such as Akinnefesi and Philips [18], Ajayi [4], Ojo [19] and Salami [20] have been conducted on the determinants of money supply in Nigeria and have established the independence of the money multiplier to the control of Central Bank of Nigeria (CBN). Other studies, including Lone and Yadav [21], Gashaw [22] and Lodha and Lodha [23], have also analyzed the relationship between the money multiplier and money supply with varying outcomes. While Lodha and Lodha [23] found that the money multiplier had an insignificant effect on money supply between 1980 and 2012, Gashaw [22] stated that a direct relationship exists between the money multiplier and money supply given that a decline in the reserve’s ratio (which is a denominator in the multiplier) raises the value of the money multiplier and ultimately raises the money supply. Elueni [1] investigated the money multiplier and control of money supply in Nigeria and concluded that the multiplier is not independent of policy actions of the monetary authorities. This paper agrees with Elueni’s [1] submission but contends that other factors such as political factors or interferences, demand for currency and current account deposits could affect the money supply in addition to the money multiplier. Further, the studies reviewed above were carried out between 1978 and 2000s leaving a gap in time perspective. This work has filled this gap by extending the scope of study from 1986 to 2017 in which data were available for analysis. The choice of the period is to cover the era of deregulation policy as well as adjustment and economic reforms period in Nigeria. The literatures discussed above have not given a detailed modelling process and comprehensive derivation of the money multiplier as it affects changes in money supply in Nigeria. The study has covered this space as well.

MODELLING

Modelling by Money Multiplier Approach to Money Supply Determination

Using the money multiplier approach in Ajayi [4], the standard idea in the determination of the stock of money was developed by Brunner (1961), and elaborated by Brunner and Meltzer (1964) and Cagan (1965). This paradigm has since been adopted as the standard model for determining money supply. The approach viewed the supply of money as the product of interaction between three variables-the money multipliers, the demand for and the supply of monetary base. The demand of monetary base is the sum of non-bank public’s demand for currency and the demand for reserves by the banking public. The demand for monetary base can be further disaggregated to include currency with the non-bank public ( ), demand deposits with commercial banks ( ), when money is narrowly defined, or currency with non-bank public ( ), demand deposits ( )-funds in current or chequing accounts-and saving and time deposit ( ) when the broad definition of money is adopted [4].

The supply of monetary base, on the other hand, is determined by the public sector deficit, commercial banks’ loan to the private sector and the balance of payments [1]. The money multiplier is derived as follows:

Given that narrow money is:

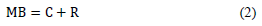

where and are as previously defined, the demand for monetary base ( ) is defined as the sum of currency ( ) and reserves ( ) held by banks. This is given as equation 2 below;

R is the base money which is a liability to the banks and it consists of currency in circulation plus the deposit money banks’ reserves with the central bank. The behavior of banks is usually described as a proportion of their reserves to total deposit liabilities. This assumes that the central bank operates a very simple system of reserve requirements, with required reserves ( ) given as:

where

0<r<1

'r' is the reserve ratio and its change constituting a monetary policy. Assume that the actual reserves ( ) is always equal to required reserve ( ), so that there exists a zero-excess reserve, equation 3 becomes:

Similarly, C can be defined as;

where , hereafter called the -ratio, is the public desired ratio of currency to deposit holdings. Combining equations (1), (2), (4) and (5) produces the multiplier;

is the sum of all currency held by the public and transaction deposits at depository institutions.

Equation (6) describes a situation where money supply is narrowly defined. The relationship for broad definition of money, M2 can be derived as follows;

is a broader measure of money supply, adding in savings deposits, time deposits and real money market mutual funds.

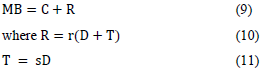

Where and are as earlier denoted and is savings and time deposits. Monetary base (MB ) is;

where s is total savings.

Substituting equations (10) and (11) into (9), yields;

Substituting equations (11) and (12) into equation (8) yields;

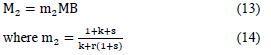

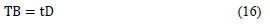

If base money is defined broadly to include reserved eligible treasury bills and development stocks (TB), reserve is then defined as;

The ratio of treasury bills to total deposit is given as;

where is total deposit within the banking system.

The money supply, base money and money multiplier relationship becomes;

Equations (16) and (17) show the inherent weakness of the simple money multiplier-that the multiplier is not unique. The simple multiplier (m) also depends, critically on two questionable assumptions, that is; constant ratios and instantaneous adjustment to equilibrium. Furthermore, the simple multiplier assumes that the ratio of bank reserves to deposit liabilities remain constant even above the minimum statutory requirements. It is not clear why this should be so because banks are expected to respond to changes in the marginal propensity to hold currency by varying their ratio of reserves to total liabilities. Moreover, the instant adjustment mechanism, implicit in the simple multiplier, appears to be over simplified.

Modelling by Determining the Money Multiplier

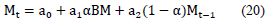

According to Akinnefesi and Phillips [18], the shortcomings in the previous models can be avoided through an alternative specification in order to determine the money multiplier. That is, by assuming that the effects of changes in the stock of money supply have a geometric lag structure, hence:

where all variables are as previously defined.

Applying Koyck transformation to equation (19) yields;

where is the multiplier, is the speed of adjustment.

Equation (20) has the advantage of implicitly assuming a stable multiplier as opposed to constant multiplier as exhibited in the simple multiplier model. Elueni [1] tested the performance of equation (20) using two definitions of money and base money with data for the period 1970-1995, and found the presence of serial correlation. To avoid this problem, the equation was estimated with the dependent variable in a differentiated form;

Equation (21) was also tested for structural stability and the accuracy of the equation by Elueni [1] who confirmed that the relationship between money supply and base money was stable in Nigeria for the period reviewed.

Modelling by Adjusted Monetary Base Approach to the Money Multiplier

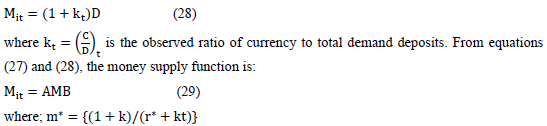

In equation (17), policy actions are reflected in the monetary base (MB) via changes in reserves (R), and in the multiplier (m) through changes in the reserve ratio (r), which shows that the impact of policy on the multiplier would render it totally exogenous and incapable of explaining changes in money supply process.

However, Garfinkel and Thorton [24] have provided solution to these anomalies by isolating the effect of policy actions on the multiplier through an adjustment to the monetary base. The adjusted monetary base (AMB) is constructed by computing the hypothetical level of reserves that would have been needed under the existing reserve requirements during a chosen base period for the current actual level of reservable deposits. Once a base period has been chosen, changes in the required reserves due to changes in reserve requirements are simply added to the monetary base.

is thus defined as:

where RAM = reserve adjustment magnitude, which is defined as:

where r is as previously defined (reserve ratio), and r* is the required reserve ratio. The RAM measures the reserves released or absorbed by changes in r(the reserve ratio) relative to r*(the required reserve ratio). In the base period, RAM is set at zero and;

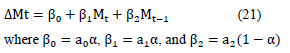

A decrease in r releases reserve into the banking system and hence increases RAM and AMB. On the contrary, an increase in reduces the reserve in the system and thus reduces AMB and RAM. Further, a combination of equations 1, 2, 4, 5 and 23 yields:

In equations (25) and (26), changes in monetary policy via changes in reserve ratio r, or actual reserve, R, are reflected in the AMB compared to changes in the multiplier. Changes in the multiplier are only a reflection of the public’s desire to hold currency relative to current accounts. That is, changes in the multiplier results in changes in the ratio of currency to total deposit ( k-ratio).

The multiplier m* in equation (26) above and (29) below, is independent of policy because the k-ratio is not directly influenced by policy actions of the government or the central bank.

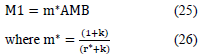

Since the demand for currency and demand current account are determined by independent factors, monetary policy actions can have relative direct effect on each of them and, therefore, on the multiplier. The channel of influence can be demonstrated by the extreme situation where the demand for currency is entirely independent of the demand for demand deposit. Thus;

where C is a constant.

As usual, we can derive our multiplier as:

The major difference between equations (28) and (29) is that in the latter monetary policy actions (adjustment in CRR-cash reserve ratio) would affect both the adjusted monetary base and the multiplier.

Overview of the Money Supply Process

The following model illustrates how variations in the monetary base MB, which the central bank can control, would lead to variations in the money supply M:

is determined by banks’ decisions on their holdings of excess reserves as represented by the excess reserve ratio and depositors’ decisions on their currency holdings as represented by the currency ratio. Over time, what has happened in practice to the money supply, the monetary base, the money multiplier, and its various determinants is that the excess reserve ratio would fall as interest rate rises, and vice versa. It is obvious that and are inversely related, and and are also inversely related. The multiplier reflects long-run increase in . M1 would expand as a result of increase in monetary base over time. It can be said, based on this process, that the monetary authority is primarily responsible for the increase in money supply, since the monetary base is controlled by the CBN. It implies that, although banks, depositors, and borrowers play significant roles, the CBN is the most important player in the money supply process in the country.

METHODS

Type and sources of data

Annual time series data collected from the Central Bank of Nigeria (CBN) Statistical Bulletin (2018) including data on the broad money supply (M2), currency outside banks, and the reserves, demand deposits, and time and savings deposits of deposit money banks (DMBs) in Nigeria for the period 1981 to 2017. The paper analyzed the data on the broad money supply (M2) in relation to the definitions of the money multiplier (m1, m2 and m3).

Econometric pre-test and analytical technique

Econometric pre-test for unit root (stationarity test) using Augmented Dickey-Fuller technique which was conducted to avoid spurious regression and to enable us make prediction on the basis of reliable results. A cointegration test was run and vector error correction model was employed as the technique of analysis.

RESULTS AND DISCUSSION

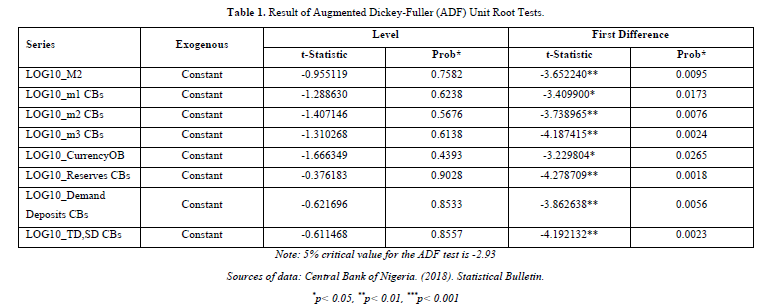

Unit root test result

Preceding the estimations, we determine the order of integration of the variables used. The result in Table 1 shows that all the variables of study were not stationary at level but stationary at first difference at the 5% level of significance. The possibility of a long-run relationship among the variables therefore, exists, given that the variables are I(1). These conditions necessitate a test of cointegration among the variables.

Tests for cointegration

The Johansen [25] test for cointegration was employed to ascertain the existence of long run cointegration among the variables. The results are presented on Appendix A. The results show the existence of long run cointegrating relationships among the variables in each of the three models using the three different definitions of the money multiplier. These results necessitate the application of the Vector Error Correction (VEC) model in the analysis of the relationship between the variables.

Vector Error Correction Model

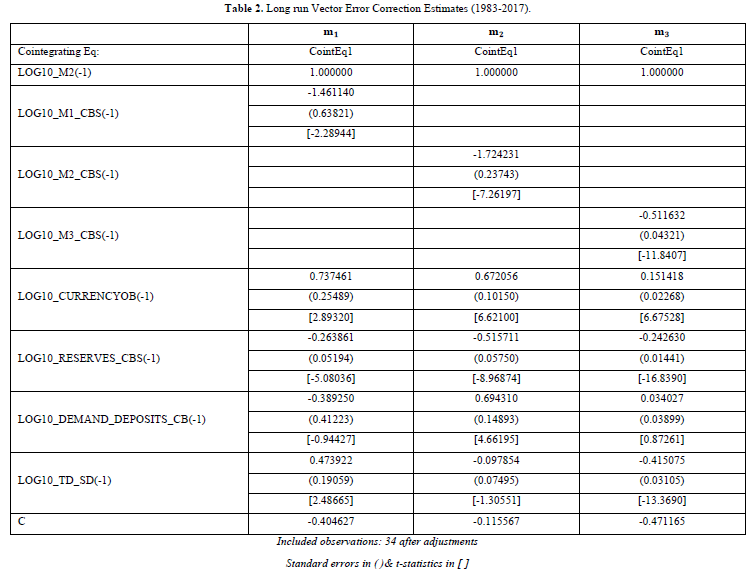

The analysis was made from the vector error correction model (VECM) regression result shown on Table 2 for the long-run model and Appendix Bfor the short-run model.

In the long run, all the definitions of the money multiplier have a statistically significant inverse relationship with the money supply at the 5% level of significance (given number of observations (n) = 34, degrees of freedom (df) = n – 1 = 33, and α = 2.035) as shown on Table 2. While had the greatest effect on the broad money supply with a coefficient of -1.72, relative to the other definitions of the money multiplier, had the least effect among the three at -0.5. Of the three definitions, however, had the most statistically significant effect with a t-statistic of 11.84, making it the most reliable measure of the three.

For the other variables, currency outside banks, in all three models, and demand deposits, in the model, had a statistically significant direct relationship with the supply of money in the long run at the 5% level of significance. On the contrary, reserves of deposit money banks, in all three models, had a statistically significant inverse relationship with the supply of money in the long run. Time and savings deposits were, however, found to have a bi-directional long run relationship with the supply of money. While the model indicates a direct relationship between time and savings deposits and the supply of money, there is an inverse relationship between the variables in the model. Although both results are statistically significant, the result from the model, having a greater absolute value of 13.3 for the t-statistic, is the more statistically significant of the two.

The short run analysis is derived from the regressed result in appendix 2B in annexure based on the lagged values as specified by:

Although in the short run, all the three definitions of the money multiplier are statistically not significant at the 5% level of significance for both the first and second lags of the multiplier, the second lag of the definition of the money multiplier has the highest t-statistic at 1.64 as shown on Appendix B. In addition, all of the first and second lags of the three definitions of the multiplier (with the exception of the first lag of ), have a direct relationship with the broad money supply. This is contrary to the result found in the long run model where an inverse relationship exists between the multiplier and the money supply. A percentage change in D(LOG10_M3_CBS(-2) (log of the second lag of the money multiplier) is associated with a 54.2% increase in LOG10_M2 (log of broad money supply) on average, ceteris paribus, in the short run. This is in contrast to the 124.4% and 120.6% increases associated with and , respectively.

The speed of adjustment from the previous period’s deviation from the long run equilibrium in the current period is highest in the model at 33.3% and lowest in the model at -17.9%. The speed of adjustment in the model is 13.4%. Only the model has a negative sign for the error correction term which confirms the existence of a co-integrating relationship in the model. The error correction term is, however, statistically not significant in all the models at the 5% level of significance. Of the three models, the model has the highest R-squared at 53.8% and the highest adjusted R-squared at 23.8%, indicating that the independent variables in this model explain better the variations in the money supply when compared to the other models. The same model also has the highest F-statistic, an indication that it is the more accurately specified model of the three.

DISCUSSION OF FINDINGS

The empirical analysis has provided insight into the determination of money supply through the money multiplier in Nigeria. The definition of the money multiplier, which includes reserved eligible treasury bills and development stocks in addition to the sum of all currency held by the public and transaction deposits at depository institutions that define and savings and time deposits, which in addition to the defining components of , define , provides the most robust determination of the money supply in Nigeria for the period from 1986 to 2017. The significant inverse relationship between (and, indeed and ) and money supply in the long run analysis contradicts Gashaw [22]. While it would be expected that larger reserves, which constitute the denominator in the money multiplier, will cause a decline in the value of the multiplier and ultimately cause a decrease in the money supply, the opposite is true in the case of Nigeria during the period under study.

The analysis in this work implies that money supply affects the real economy through interest rates, inflation, spending, investment, and employment. But the strength and nature of the relationship between money supply and the real economy vary depending on many factors, like the state of the economy, productivity of labour and how people behave. It could further be deduced that if the money supply grows faster than the ability of the economy to produce goods and services, inflation tends to rise. Nevertheless, the strength of the link between money supply and inflation depends on how people and businesses react to the extra money in the economy. In terms of the relationship between money supply and foreign exchange rates, an increase in a country’s money supply tends to reduce the value of its currency (depreciation), while a decrease in money supply leads to appreciation-ceteris paribus.

Furthermore, an increased money supply could have a supportive effect on financial inclusion, but financial inclusion could also influence how changes in the money supply affect the economy as a whole. It implies a mutually reinforcing relationship that depends on policy design, infrastructure, and access to financial services. Therefore, it could be concluded that while increasing the money supply can stimulate growth and support financial systems, doing it recklessly or excessively can cause serious economic problems in any given economy. Hence, the need to control money supply and influence other macroeconomic variables positively.

CONCLUSION AND POLICY IMPLICATIONS

This study has reviewed the conceptual and theoretical issues on money multiplier and the supply of money process as basis for modelling. It has also attempted a narrative of the practical exercise of applying the money multiplier and supply analysis. It is anticipated that the modelling approaches applied will be useful guides to policymakers. The analysis of money multiplier and the levels of money supply are essential conditions for economic stability and growth. Excessive and uncontrolled levels of money supply could lead to inflation and may create adverse incentives for private investors or governments to carry out activities that encourage long-term growth. Projections of money multiplier dynamics to money supply transmission mechanism are modelled based on monetary variables. The models used in this study were derived from the macroeconomic framework in use. The study acknowledges the fact that relationships between macroeconomic variables are never static; indeed, they often undergo some significant changes through time because of intervening events which need to be factored into the analysis. This is true of money supply and its multiplier effects.

Regarding arguments on the stability properties of money multipliers, this study has intended to model the behavior of money multipliers as they affect the money supply process. Additionally, the study was motivated to examine the degree to which monetary endogeneity in the Nigerian money supply process could be proved through an endogenous money multiplier framework when interest rates are determined by the market. The latter is crucial given the discernible disassociation between the growth of reserve money and the increase in broad money aggregates, so that innovations in the money multiplier would seem to have a significant impact on the movement of broader money aggregates.

The study affirms that the control of money supply is undoubtedly a formidable task. The economic environment that shapes money supply is highly uncertain given the large sphere of the informal sector and the unbanked population in Nigeria. It implies that a credible commitment of government in terms of a particular policy stance on this issue is required to effectively control money supply in the country. The study has shown that money multipliers provide useful insights into understanding the changing nature of the money supply process, provided the money multiplier framework takes into cognizance the various endogenous impacts from relative rates of return and other macroeconomic variables. Such an approach facilitates a better appreciation of the movements in the money multiplier particularly in the post-reforms period and, also, explains broad money movements. The study concludes that relative stability in narrow and broad money multipliers was attained because of the financial liberalization witnessed in the economy since 1986 as the monetary base is controlled by the Central Bank of Nigeria. So, the money multiplier attests to money creation in the economy, implying a direct link between the balance sheet position and monetary aggregates in relation to prices and the real economy. We thus conclude that the Central Bank of Nigeria is primarily responsible for the increase in money supply in the country. In this sense, although banks, depositors, and borrowers play a part as well, the CBN is the most significant participant in the money supply process in the economy.

The Central Bank of Nigeria should continue to regulate the amount of money in circulation by managing inflation first before targeting to reduce unemployment and moderate the rates of interest in the economy. This suggestion is in conformity with the tight monetary policy in the country. Government can intensify usage of monetary policy tools such as open market operations (quantitative easing), reserves requirements and discount rates to control the current inflationary pressures in the country. It implies that alternative approaches to the control of monetary variables should be targeted at moderating money supply levels in the economy. Considering the increasing stochastic economic environment in Nigeria, the use of probabilistic techniques such as Monte Carlo simulations and value at risk (VAR) models are hereby canvassed as useful policy guides or choices for monetary authorities and policymakers. Running Monte Carlo is the best way to analyze big uncertain decisions such as the complex money supply process as attested to by economic and financial expert Hubbard (undated) [26].

Based on the findings, the paper recommends that:

(Note: The authors hereby acknowledge that the paper benefitted from the theoretical literature in Elueni Andrews [1]).

No Files Found

Share Your Publication :